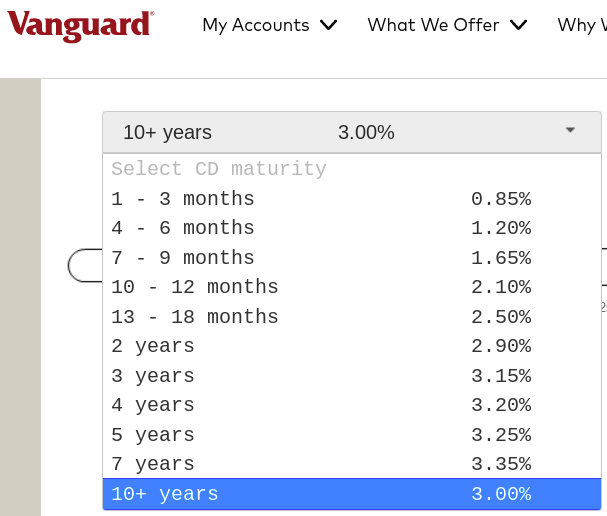

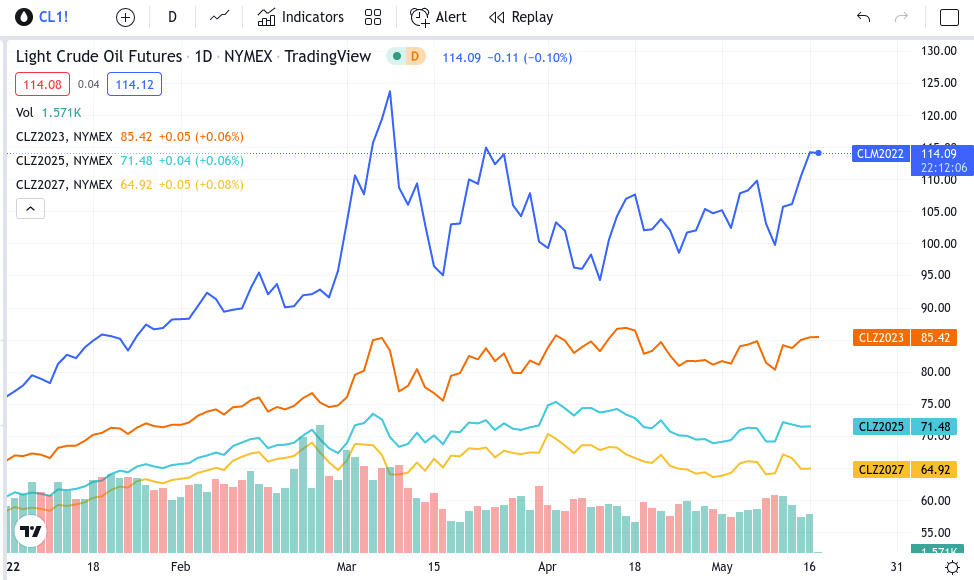

Here's another thing I don't understand. Crude oil futures:

Blue line is cash/spot price. Then the other lines are further out in time. Orange line Dec 2023, turquoise Dec 2025, yellow Dec 2027. Futures are predicting a decline from $114 currently to only $65 by the end of 2027.

This is known as backwardation. Although not evident from the chart, I presume the normal condition is contango as happened in 2020. Cash price plunged below $20, but everyone understood it was an anomaly.

Energy is only one component of the economy, but it's hard to maintain 8% inflation when gas prices are plunging.

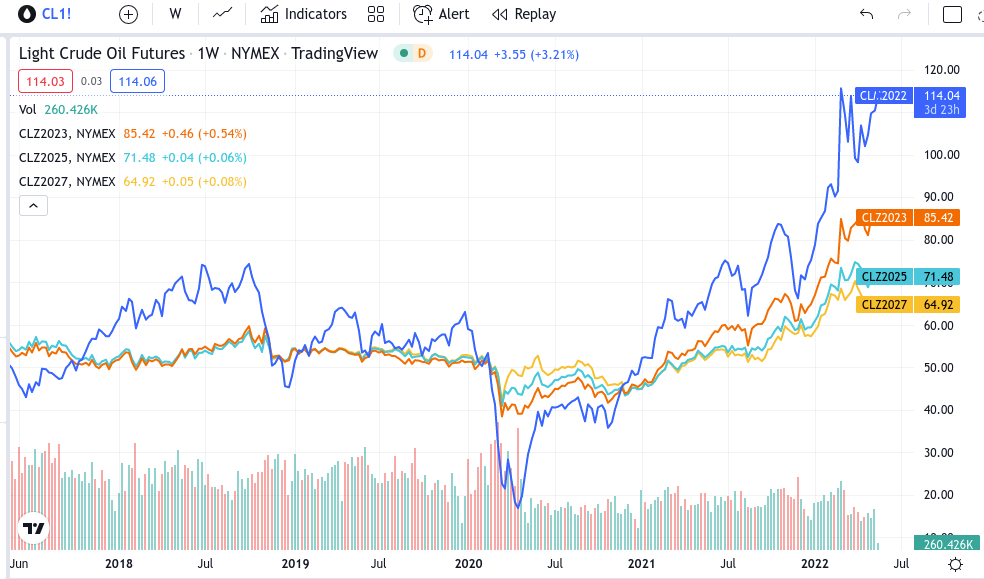

I'm trying to figure out how to do a similar chart for gold. Gold is projected to rise. Currently $1825, December 2027 futures price is $2035. But that's only about 2% increase per year.

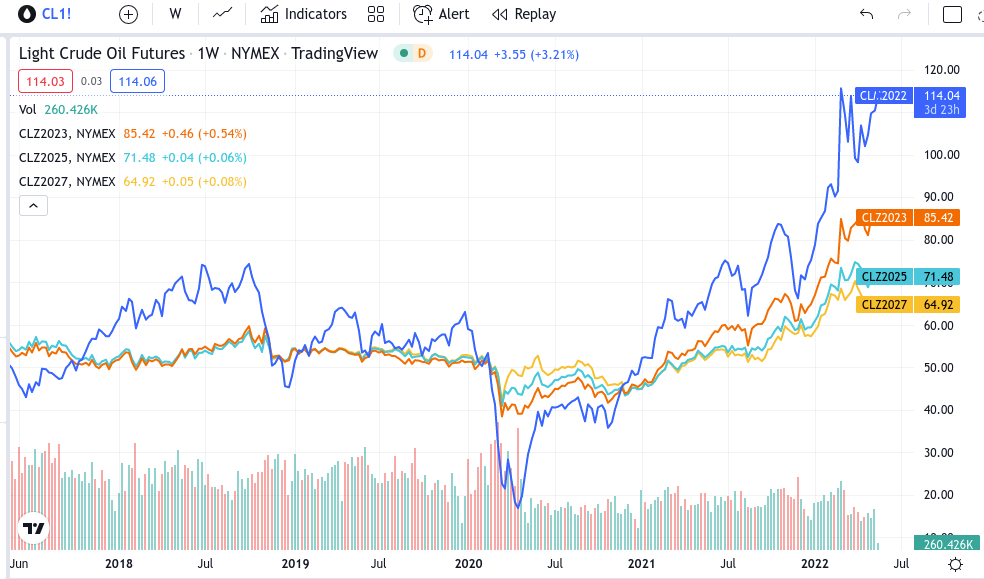

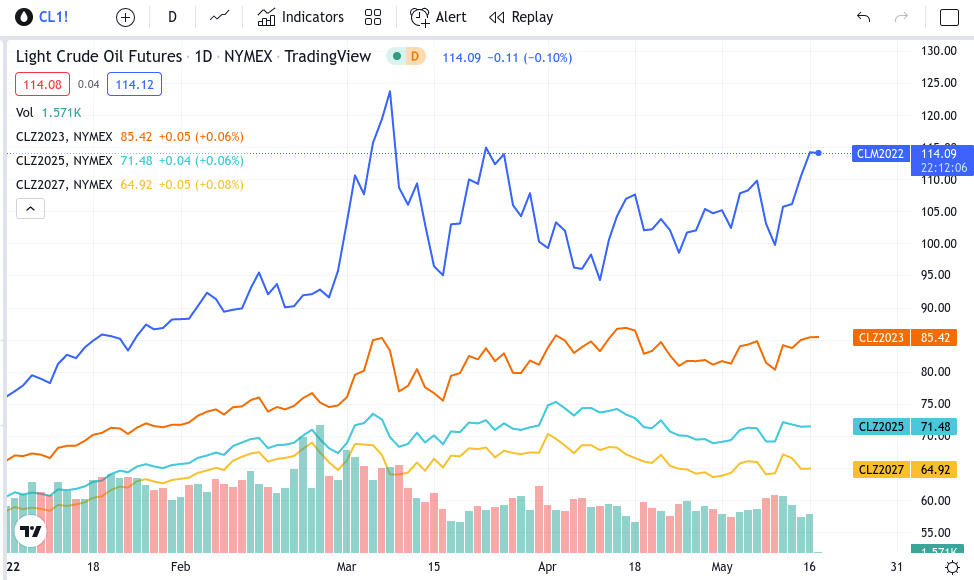

And we know 5 to 10 year Treasury yields are below 3%. Markets do not believe inflation will persist at these levels. Here's the same oil chart from above, but zoomed in year-to-date:

Blue line is still trending higher, but the long-dated pricing is actually slipping lower.