I replenished my gold miners today.

Gold is obsolete because everyone buys crypto now instead.

MARKETS,Anybody even yet?

-

dinghy

- Video Poker Master

- Posts: 1337

- Joined: Mon Apr 29, 2019 8:24 am

-

olds442jetaway

- Video Poker Master

- Posts: 9406

- Joined: Tue Aug 21, 2007 9:08 pm

I’ll take the gold!

-

FAA

- Video Poker Master

- Posts: 8546

- Joined: Wed May 28, 2014 11:58 am

Relieved to only have lost a tenth of yesterday's total. Fifty basis point decision will only induce more chaos into the system. 13,000 Nasdaq returning in 2025.

-

olds442jetaway

- Video Poker Master

- Posts: 9406

- Joined: Tue Aug 21, 2007 9:08 pm

Couldn’t even hold a mini rise today. Bummer. Not looking good going forward.

-

dinghy

- Video Poker Master

- Posts: 1337

- Joined: Mon Apr 29, 2019 8:24 am

-

dinghy

- Video Poker Master

- Posts: 1337

- Joined: Mon Apr 29, 2019 8:24 am

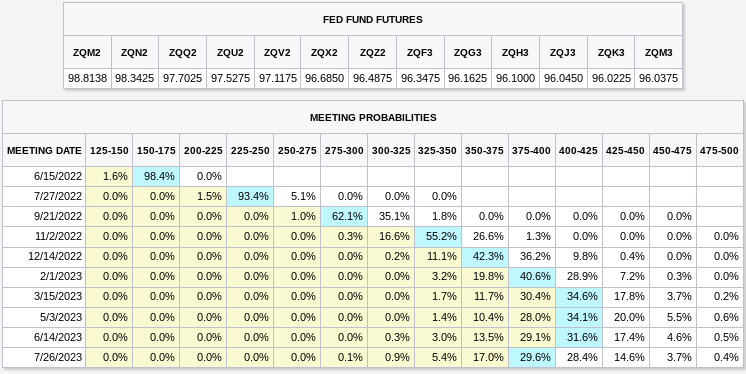

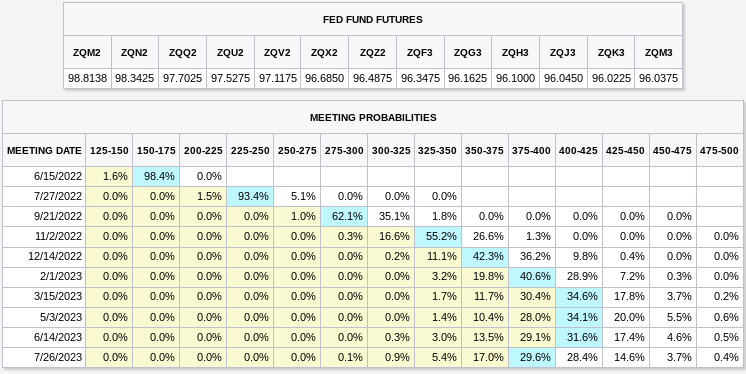

Latest probabilities:

https://www.cmegroup.com/trading/intere ... -fomc.html

Current rate is 75-100 bips. The market is expecting +75 tomorrow, then another +75 by late July. Forecast is uncertain after that, but the probabilities stall out around a 4% rate in early 2023.

https://www.cmegroup.com/trading/intere ... -fomc.html

Current rate is 75-100 bips. The market is expecting +75 tomorrow, then another +75 by late July. Forecast is uncertain after that, but the probabilities stall out around a 4% rate in early 2023.

-

olds442jetaway

- Video Poker Master

- Posts: 9406

- Joined: Tue Aug 21, 2007 9:08 pm

I think if they can get inflation down to 4 percent, they will be happy with that and that will be the new norm. If so, the darn banks better step and pay for savings accordingly. I mean heck some are charging 22 percent or more on credit card debt. When I opened my own first bank account at age 7, ( the class went to the bank with our books of dimes filled up ) they were even paying 3-4 percent in 1955. I checked the current insanity at our local credit Union today. .35 of one percent for a one year cd. I will be closing them out in short order until they get the message. Actually , myself and 3 friends are all going down there at once and closing everything out. Not peanuts either in our accounts!

-

dinghy

- Video Poker Master

- Posts: 1337

- Joined: Mon Apr 29, 2019 8:24 am

I go wherever I find value. CDs haven't been relevant (to me) in many years. Often, the ordinary savings account yield is competitive with CD yields, and during some periods such as now, I avoid banks almost entirely in favor of Treasuries and/or corporates.olds442jetaway wrote: ↑Tue Jun 14, 2022 10:14 pmI think if they can get inflation down to 4 percent, they will be happy with that and that will be the new norm. If so, the darn banks better step and pay for savings accordingly.

For the Fed and inflation, I expect ongoing instability. Inflation may be 8 to 10% one quarter, and then zero or negative shortly thereafter. Also, some categories may run very hot while others are level or deflating.

-

dinghy

- Video Poker Master

- Posts: 1337

- Joined: Mon Apr 29, 2019 8:24 am

Do you avoid investments in companies you consider morally objectionable?

I just bought more NEM Newmont below 62. Only gold miner in the S&P 500. I looked at their Twitter feed, and it's all rainbows, transsexuals, and climate change.

I just want the company to mine gold.

I just bought more NEM Newmont below 62. Only gold miner in the S&P 500. I looked at their Twitter feed, and it's all rainbows, transsexuals, and climate change.

I just want the company to mine gold.

-

olds442jetaway

- Video Poker Master

- Posts: 9406

- Joined: Tue Aug 21, 2007 9:08 pm

I think .75 is already priced in to the market, therefore I’m holding on sqqq buy till we get a bear market bounce. I think that will be imminent. For now, anything I own I can sell and make a few hundred on, I’m out.