MARKETS,Anybody even yet?

-

olds442jetaway

- Video Poker Master

- Posts: 11423

- Joined: Tue Aug 21, 2007 9:08 pm

Re: MARKETS,Anybody even yet?

Good for you. I have been learning about it on Josh with stocks. It’s just not for me. Maybe if I was younger.

-

FAA

- Video Poker Master

- Posts: 9472

- Joined: Wed May 28, 2014 11:58 am

NASDAQ -2%! Talk about an about face/slap in face.

-

onemoretry

- Video Poker Master

- Posts: 3106

- Joined: Tue Mar 03, 2009 8:00 pm

-

FAA

- Video Poker Master

- Posts: 9472

- Joined: Wed May 28, 2014 11:58 am

I hate the profit taking sell off days. So much profit lost by the longs.

-

olds442jetaway

- Video Poker Master

- Posts: 11423

- Joined: Tue Aug 21, 2007 9:08 pm

UBS downgraded Tesla to a sell. Just a guess. Could be the beginning of the long awaited correction, but who knows.

-

Koren55

- Forum Rookie

- Posts: 11

- Joined: Fri Feb 09, 2024 1:23 am

March and April 2020 were the best times to invest in casinos and cruise lines. They all took a hit from Covid.

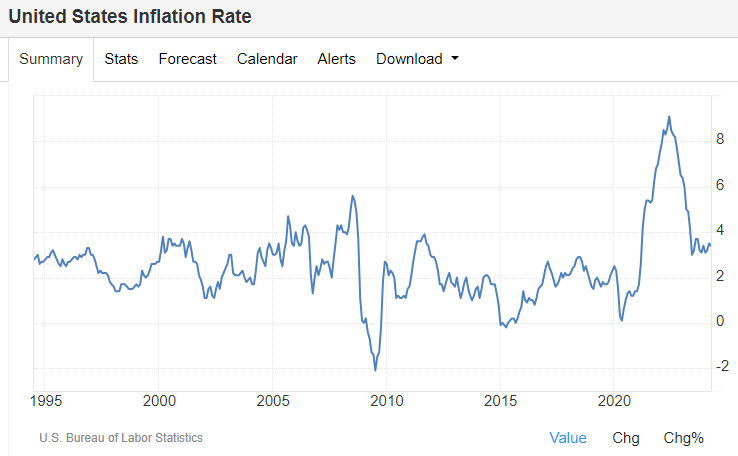

Now it’s over four years later, an economic disaster was averted by Washington, inflation is heading down, and the market is doing fine.

Fortunately I bought MGM and Royal Caribbean in March/April 2020. two of my favorite companies.

Since then, my MGM investment has more than quadrupled and my RC investment more than tripled. Those are two keeper stocks, held long term.

Now it’s over four years later, an economic disaster was averted by Washington, inflation is heading down, and the market is doing fine.

Fortunately I bought MGM and Royal Caribbean in March/April 2020. two of my favorite companies.

Since then, my MGM investment has more than quadrupled and my RC investment more than tripled. Those are two keeper stocks, held long term.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

-

olds442jetaway

- Video Poker Master

- Posts: 11423

- Joined: Tue Aug 21, 2007 9:08 pm

I have been nibbling at sqqq to offset profit taking by the big boys and girls. Also doing some very short term trades while on my mini vacation from VP. It’s a lot cheaper, but not much fun and lots of homework. Reminds me of an amplified JoB session. I still have one finger on the sell button. This can’t last forever. Here’s my Fidelity graph YTD. All 100 percent self directed. I just ask my advisor what to do. O that would be me.

- Attachments

-

- IMG_4554.jpeg (29.04 KiB) Viewed 3077 times

-

case

- VP Veteran

- Posts: 932

- Joined: Thu Feb 10, 2011 7:37 am

I also bought some sqqq last week. Looks good for us now but the key is to sell at the right time. If we get a correction then be ready to sell

-

case

- VP Veteran

- Posts: 932

- Joined: Thu Feb 10, 2011 7:37 am

I mean sell after the correction looks done