MARKETS,Anybody even yet?

-

FAA

- Video Poker Master

- Posts: 9541

- Joined Forum: May 28, 2014

- View Player Page

Re: MARKETS,Anybody even yet?

AWF Still where it was 32 years ago, but I’ll take the 8 percent regular dividend.

-------------------------------------------------------------------------------------------------------------

Sounds like my future with JNJ up 1.8% since 2020. Boring but top five percentile for safety. As for AWF, WTF. It is -20% since 2015. Most investors are furious with themselves or their representatives! You are fortunate enough to have ridden out the variance and lived to tell the tale.

-------------------------------------------------------------------------------------------------------------

Sounds like my future with JNJ up 1.8% since 2020. Boring but top five percentile for safety. As for AWF, WTF. It is -20% since 2015. Most investors are furious with themselves or their representatives! You are fortunate enough to have ridden out the variance and lived to tell the tale.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined Forum: April 29, 2019

- View Player Page

Trump spent several days ranting about firing Powell. Finally someone told him he's not allowed to, so this afternoon he dropped that he has "no intention" of firing Powell.

US stocks have spiked nearly 2%+, added to the regular session gains.

Gold extended its crash:

I'm adding back GDX shares which I sold yesterday above 53.

Never a quiet day anymore

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined Forum: April 29, 2019

- View Player Page

I wouldn't pick that particular fund, but it's had good returns by bond standards. Dividends have far outweighed the 20% price decline. I wouldn't want to own it though in a severe bear market where corporations begin defaulting on their debt.

-

olds442jetaway

- Video Poker Master

- Posts: 11569

- Joined Forum: August 21, 2007

- View Player Page

Picked up my first batch of ET today. 8 percent dividend play. Good dividend history. I never knew until I read it earlier today that throughout history, 90 percent of Market returns are from dividends. Forget the source. I agree by the way on more Americans owning gold and silver. I started at a very young about age 26. Yikes that was 50 years ago. Before that, at age 10, collecting American coins. Realized by my teens that selling them was a loser unless you sold them privately. In hindsight, at age 10, I should have started to fill a 55 gal drum with silver coins. Then dumped when the Hunt brothers pumped up silver to 50. I never bought coins except a 3 or 4. Always from paper route or going through bags of Pennie’s on Rainey days. AWF is a very tiny part of my stash. It just happens to be my oldest non living friend. Probably should have reworded that. Most all of my lifetime men friends are gone. The women still outlive us. Now my former trainees are my friends now and they are all retired but one.

I told them all early on to forget the new Muscle car and big car payment and max out the IRAs, 401ks 403bs etc. They all listened to me and are thanking me now. And most by now got any car they wanted or homes, yet remained Conservative.

I told them all early on to forget the new Muscle car and big car payment and max out the IRAs, 401ks 403bs etc. They all listened to me and are thanking me now. And most by now got any car they wanted or homes, yet remained Conservative.

-

olds442jetaway

- Video Poker Master

- Posts: 11569

- Joined Forum: August 21, 2007

- View Player Page

Whoops! Sorry forgot. I do have some on line guy and gal friends here on the forum and a few older than me.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined Forum: April 29, 2019

- View Player Page

I love the energy sector, but K1s intimidate me. So I've avoided pipeline companies. I need to learn more.olds442jetaway wrote: ↑Tue Apr 22, 2025 5:59 pmPicked up my first batch of ET today. 8 percent dividend play. Good dividend history.

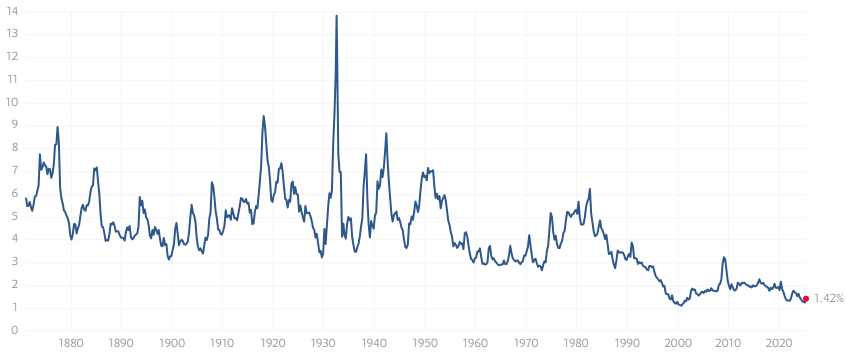

Seems hard to believe, but it may have been true in the distant past.I never knew until I read it earlier today that throughout history, 90 percent of Market returns are from dividends. Forget the source.

https://www.multpl.com/s-p-500-dividend-yield

Chart is labeled S&P 500, but the index doesn't go back that far. They must have supplemented with other data, such as maybe for the Dow.

The early portion of the chart was before we were blessed with the income tax. The gradual loss of enthusiasm for dividends may be related to taxation or other regulatory factors.

-

olds442jetaway

- Video Poker Master

- Posts: 11569

- Joined Forum: August 21, 2007

- View Player Page

Yep I’m sure

-

FAA

- Video Poker Master

- Posts: 9541

- Joined Forum: May 28, 2014

- View Player Page

UNH CEO took a 34% haircut to $16.4M. Got to cut the fat starting at the top.

-

olds442jetaway

- Video Poker Master

- Posts: 11569

- Joined Forum: August 21, 2007

- View Player Page

I did a quick read on ET. The tax stuff doesn’t seem too bad. They will have their k-1s on line and you can call and get hard copies mailed. They also have a tax package with reporting instructions. They are a MLP. Master Limited Partnership so the company income flows to the shareholders and is reported on our own returns . We may get a break on the tax rate too. There is one Booby trap I may have to look into. The possibility of having to file non resident State Income tax returns. If that’s the case, I’m out. Maybe I will call the company tomorrow about the State tax issue if any.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined Forum: April 29, 2019

- View Player Page

My impression is that you're probably okay unless the dollar amounts are really big. For many states, you aren't required to file if you're under a designated threshold. Failing that, you could just ignore if the numbers are small, and probably no one will care.olds442jetaway wrote: ↑Tue Apr 22, 2025 7:44 pmThere is one Booby trap I may have to look into. The possibility of having to file non resident State Income tax returns.

Aside from any of that, I hate having to maintain running totals from year to year. Probably the tax software will handle it adequately, but it's another thing that can go wrong.