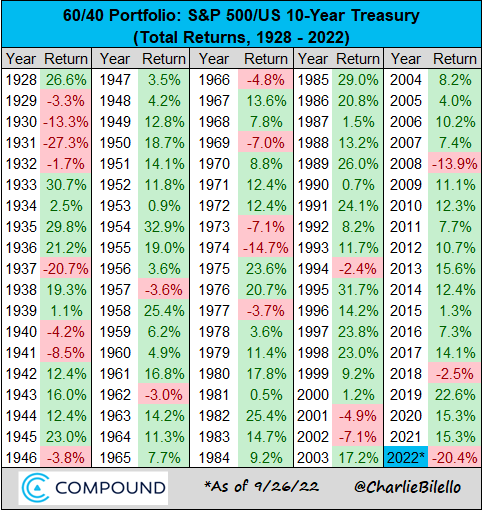

The market action is not making sense to me. Here's the year-to-date:

Energy stocks are collapsing. XES is now negative for the year, ignoring dividends.

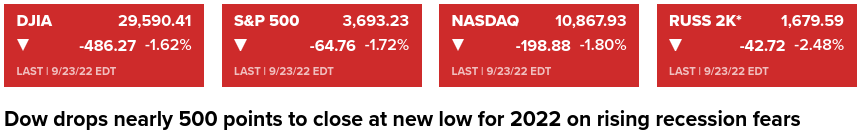

So far so good, because CNBC says investors fear recession:

But if the fear is recession, how can you have TLT crashing?

The dollar index usually tracks along with TLT, but this year they're polar opposites.

The recent action looks like across-the-board panic liquidation -- which could continue because we know October is a vulnerable month. But once the bottom is in, I think either TLT or XLE rips higher.

I want to own both. Just have to decide which energy stocks to add. My PBR and YPF have performed so strongly that I'm preferring to find other, more beaten-down names. Will probably start with XES.

Edit: Also like the CRAK refiners ETF, although it's a little expensive at 0.6% annually.