MARKETS,Anybody even yet?

-

wildman49

- Video Poker Master

- Posts: 1363

- Joined Forum: October 5, 2012

- View Player Page

Re: MARKETS,Anybody even yet?

Been looking over what has been my best trader and I the biggest bulk of my YTD profit is in trading BITO. Sometimes I think I should forget the other junk and stick to what's working.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined Forum: April 29, 2019

- View Player Page

Near-term, I like my miners even if gold remains stuck in neutral at 3300.

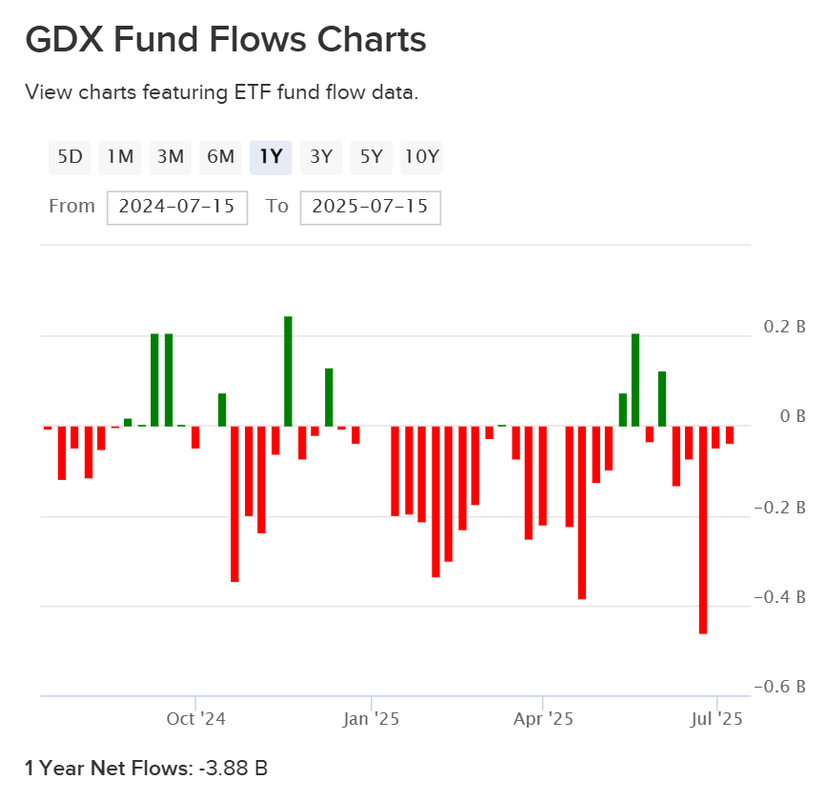

GDX fund flows have been horrific.

https://etfdb.com/etf/GDX/#fund-flows

No one of substance is holding or even looking at the miners. Everyone inclined to sell has already done so.

I guess I'm a trader by necessity. I don't set out to trade actively, but I regularly see moves that don't make sense, and I have to react.

I think my biggest individual moneymaker this year has been SBSW. It's nearly a triple off the February lows, and I've further juiced my returns by trading the fluctuations. I still like the prospects for platinum, but I've sharply reduced my share count. I just can't like the stock as much near $9 as I did at 3.

-

TripleTriple

- VP Veteran

- Posts: 906

- Joined Forum: August 31, 2019

- View Player Page

O Great Wise One- dost thou seeth any plays in the pharma/biotech sector?

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined Forum: April 29, 2019

- View Player Page

Olds should be back shortly. While he's away, my only such holdings are BAX, XBI and UNH.TripleTriple wrote: ↑Thu Jul 17, 2025 12:13 pmO Great Wise One- dost thou seeth any plays in the pharma/biotech sector?

BAX has been a severe laggard. Unfortunately I can't remember why I own it.

XBI looks cheap compared to most other sectors, but it's had a bit of a rebound along with everything else.

I wrote here about UNH as I was buying it, but it was somewhat of a blind stab. It's still cheap by some measures. I guess it's not technically pharma or biotech, but I may not know the difference

-

olds442jetaway

- Video Poker Master

- Posts: 11569

- Joined Forum: August 21, 2007

- View Player Page

Hey TT……I’m definitely not the Great wise one, but I’m not really into that pharma sector. Not really into biotech either. Mostly holing dividend plays to keep the income stream coming, natural resources similar to Dinghy, and a few Mortgage stocks. My 403b does have the mag 7 in it, but my every day acct is the above and similar to Buffett cash. One note….if Trump fires Powell and gets his own people in there, bad for cash and CDs which will go to 0-2percent IMO. Not sure how the market would react, but probably up after a short term panic. Like Wildman says, the Buffett retiring scenario is still taking its toll on Berkshire, that I started acquiring in the beginning of the slide.

-

olds442jetaway

- Video Poker Master

- Posts: 11569

- Joined Forum: August 21, 2007

- View Player Page

One final note. EXEL has already made a big run in 2025. From what I read, it’s listed as fairly valued. For the most part, I stick with dividend stocks paying over 4 percent. The big downside of course is you are taxed in the year the dividend is paid. I will dump on minimal gains sometimes and dump the losers for a tax writeoff, buying back after the 30 day wash rule at the cheaper price as long as they haven’t cut the dividend.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined Forum: April 29, 2019

- View Player Page

Don't ignore the currency. Trump's smokescreen issue is tariffs, but his underlying concern is trade deficits and US manufacturing. His objectives require a weak dollar.olds442jetaway wrote: ↑Thu Jul 17, 2025 7:49 pmif Trump fires Powell and gets his own people in there, bad for cash and CDs which will go to 0-2percent IMO.

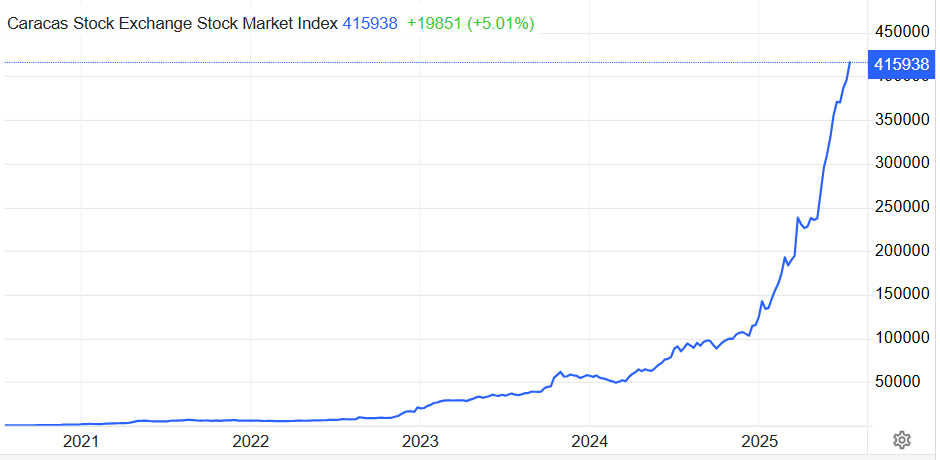

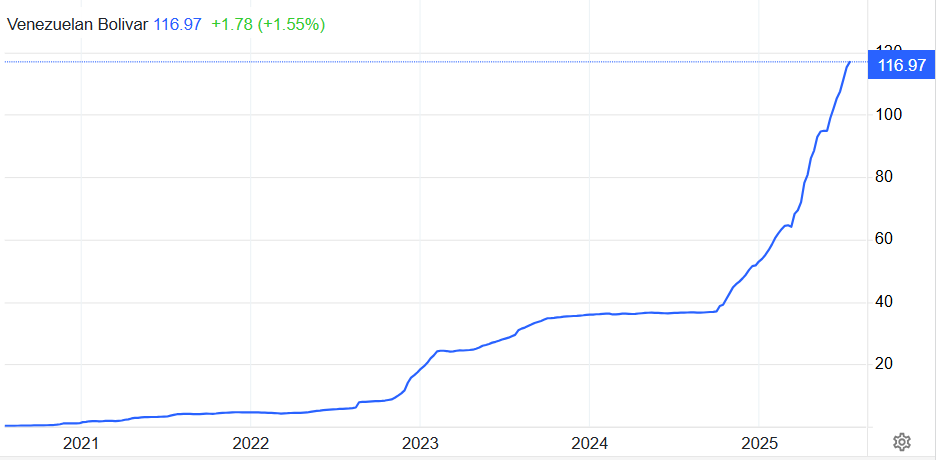

I think the top stock market this year is this one:

Oh, but how's the currency doing?

That means it's crashing against the dollar. Officially. They probably have black market rates and stuff.

My point is, it's possible the US market could rise while losing real value because it's denominated in Monopoly money.

-

olds442jetaway

- Video Poker Master

- Posts: 11569

- Joined Forum: August 21, 2007

- View Player Page

Interesting. The tariff stuff is far from over that’s for sure.

-

olds442jetaway

- Video Poker Master

- Posts: 11569

- Joined Forum: August 21, 2007

- View Player Page

This penny stock I bought is starting to take off. New explorations in BC. Promising. I’m up 20 percent, but leaning toward holding for a better run. Any thoughts?

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined Forum: April 29, 2019

- View Player Page

No further insight. I haven't been watching to know why it's moving.

On a possibly related note, I sold completely out of my PPTA Perpetua which I only started buying last month. Average buy low 12s, average sell high 15s -- so nearly a 30% profit. It felt too much like I was chasing a fad dependent on support from DC. That's not my game. After my last sale yesterday at 16.66, it ran up another $1

Plan is to reengage if it reverses to 13.50.

Looking at my broader numbers, I had another red week but still within 1% of my earlier all-time high. I'm surprised honestly at how sharply I've reduced my precious metal miners. I'm now just above 15% which is big but down a lot from January.

If the PM miners were to extend their current dip, I would not necessarily be disappointed. I'm prepared to buy heavily if properly motivated. My #1 buy target is AGI Alamos, which yesterday revisited the 24s. Earnings report comes Wednesday the 30th after the close.

NGD reports Monday the 28th after the close. HL Hecla is expected in early August.

NEM Newmont's release Thursday the 24th (after) is highly anticipated. An NEM disaster could crash the entire complex, setting up bargains in other miners which aren't incompetently managed.