MARKETS,Anybody even yet?

-

FAA

- Video Poker Master

- Posts: 9474

- Joined: Wed May 28, 2014 11:58 am

Re: MARKETS,Anybody even yet?

Good News: Apple hit $220.

Disastrous News: Lilly -14%.

FML.

Disastrous News: Lilly -14%.

FML.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

If I liked the stock at 760, I would consider adding at 640.

But I know nothing about it. I may need a UNH-caliber decline to tempt me in.

I see the company inspired a sucker ETF: LLYX. In theory it doubles the performance of LLY, but its ingredients include a >1% expense ratio and a tablespoon of tracking error.

-

olds442jetaway

- Video Poker Master

- Posts: 11438

- Joined: Tue Aug 21, 2007 9:08 pm

Expense ratio…..

-

FAA

- Video Poker Master

- Posts: 9474

- Joined: Wed May 28, 2014 11:58 am

Good: Apple $229.

Bad: Lilly $625!

Bad: Lilly $625!

-

tech58

- Video Poker Master

- Posts: 1469

- Joined: Tue Mar 11, 2014 1:21 pm

HNATF at .26 a buy or a falling knife?

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

I don't know. They sold off a non-core property to focus on hydrogen. The market may have disliked the sale provisions.

In a way, I'm associated because I'm buying chemical companies, and hydrogen is the #1-ranked chemical

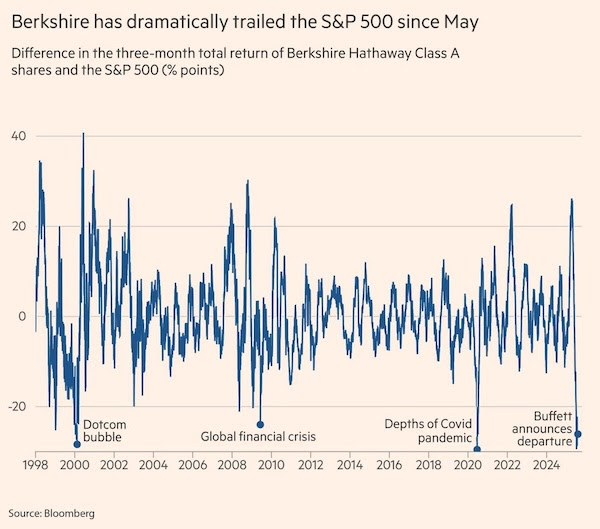

Don't try to distract me from my obsession with Berkshire.

Every time Berkshire crashes on a relative basis, it comes roaring back. I'm glad I don't own the S&P 500.

-

olds442jetaway

- Video Poker Master

- Posts: 11438

- Joined: Tue Aug 21, 2007 9:08 pm

Regarding HNATF, I almost sold mine at 39 cents for a quick hit but didn’t. I guess it is p possible that shareholders are afraid of a dilution of value regarding the in process sale. I have less than $400 infested at $.32 a share so I’m not going to lose any sleep over it one way or another however, if it somehow pops again into the high 30s, I’m out.

I’m behind the 8 ball on Berkshire even though I have been adding a share at a time on dips. I’m not overly worried. I’m sure institutions would still like to see a dividend in the 2.5-4.5 range. I know I would.

I’m keeping an eye on my Royal Gold. Looking strong. Of course Gold itself is strong too

I’m behind the 8 ball on Berkshire even though I have been adding a share at a time on dips. I’m not overly worried. I’m sure institutions would still like to see a dividend in the 2.5-4.5 range. I know I would.

I’m keeping an eye on my Royal Gold. Looking strong. Of course Gold itself is strong too

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

In the last several sessions, the miners have disconnected from gold.olds442jetaway wrote: ↑Sat Aug 09, 2025 7:51 pmI’m keeping an eye on my Royal Gold. Looking strong. Of course Gold itself is strong too

Worldwide natural resources market cap is estimated at 10-12% of total stock market. I'm attempting to maintain a 20-24% allocation -- for inflation protection, and because the sector looks cheap and unloved. Gradually I'm reducing the precious metals dominance. Last week for example, I sold most of my HL because it moved too far too fast, while bulking up my DOW and LYB.

Stocks in general have a history of poor August and September performance. I'm ready to buy in the event of a flush.

-

olds442jetaway

- Video Poker Master

- Posts: 11438

- Joined: Tue Aug 21, 2007 9:08 pm

IBM on sale and a buy? It’s back where my bought it in April. Around 234. Sold it in June. Did good. Just sold too soon. RSI is 27. Not foolproof, but on the surface a signal of being very oversold. The only negative thing I could find was a bit of trouble in its software division. It also pays an OK dividend around 2.34 percent. I will be watching it at the open tomorrow. May grab a few shares. Any opinions?

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

It's widely disparaged by contrarians. Buffett got rinsed on his IBM investment.olds442jetaway wrote: ↑Tue Aug 12, 2025 6:10 pmThe only negative thing I could find was a bit of trouble in its software division.

In a tweet last year, short-seller Jim Chanos called IBM "the granddaddy of financial engineering." The company has been accused of using non-GAAP and other accounting gimmicks to juice the stock price.