MARKETS,Anybody even yet?

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

Re: MARKETS,Anybody even yet?

SQQQ +4% in the pre.

I don't think there's any news, but the 2 year Treasury yield is now above 4.2%.

My gold miners are back to the lows, so I'll be buying on dips below GDX 23 and GDXJ 28.

Yesterday I sold off a small chunk of VGSH to raise cash, but I'm still at risk of going bwoke if we crash today or Monday.

I don't think there's any news, but the 2 year Treasury yield is now above 4.2%.

My gold miners are back to the lows, so I'll be buying on dips below GDX 23 and GDXJ 28.

Yesterday I sold off a small chunk of VGSH to raise cash, but I'm still at risk of going bwoke if we crash today or Monday.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

I'm into the tough decisions now. Can only afford to buy stocks that have had two or more limbs blown off.

Internationals are lagging. I've taken multiple swipes at VXUS.

Supposedly, stocks were spooked by strong PMI data. Doesn't make sense for commodities to be crashing if the economy is strong. In a panic, I guess anything can happen.

Internationals are lagging. I've taken multiple swipes at VXUS.

Supposedly, stocks were spooked by strong PMI data. Doesn't make sense for commodities to be crashing if the economy is strong. In a panic, I guess anything can happen.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

Wildman wins the week.

Today I had to restrict myself to gold miners and VXUS. Only other buys were PARA and VTNR. I sold significantly from my short-term Treasuries, but if Monday goes bad I'll be sitting on my hands because I have very little settled cash now.

Today I had to restrict myself to gold miners and VXUS. Only other buys were PARA and VTNR. I sold significantly from my short-term Treasuries, but if Monday goes bad I'll be sitting on my hands because I have very little settled cash now.

-

wildman49

- Video Poker Master

- Posts: 1363

- Joined: Fri Oct 05, 2012 10:45 am

Not looking to win. This market just like 2000-2001 but it's 10 times worse. The Powell pain is going to force markets to over correct just like he will raise rates to high.

The time to start to buy is when everything is hitting 52 week lows. Apple and Tesla get there we start buying.

I did buy small today XOM, USO, GLDM,SLV when the dollar rolls over commodity's will rip.

The time to start to buy is when everything is hitting 52 week lows. Apple and Tesla get there we start buying.

I did buy small today XOM, USO, GLDM,SLV when the dollar rolls over commodity's will rip.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

One jigsaw piece I don't understand is the election. If financial markets continue down sharply in the weeks ahead, the Dems are likely to lose both houses of Congress. Does Powell have full support from the Biden administration? He could potentially be thrown under the bus, considering he was appointed to the job by orange man bad. JPow could be accused of sabotaging the midterms for his insurrectionist buddy.

-

wildman49

- Video Poker Master

- Posts: 1363

- Joined: Fri Oct 05, 2012 10:45 am

The problem with stocks is money going into bonds/CDs so the money not going come back to the market for years. Powell don't care about anything but getting CPI down to 2%. Anything in his way going to get crushed.

Adding PSQ would be wise short term.

Adding PSQ would be wise short term.

-

olds442jetaway

- Video Poker Master

- Posts: 11496

- Joined: Tue Aug 21, 2007 9:08 pm

In and out of sqqq again, but the rest of my stuff is getting hammered. As far as I know, there has never been a market turnaround to the upside if the Fed was still raising interest rates and that will continue. Their 2% inflation goal is unrealistic. I think Elon Musk made the right call. Heading into deflation. T

-

advantage playe

- Video Poker Master

- Posts: 1913

- Joined: Sat Oct 21, 2017 11:38 am

The dems may lose the house and senate, now thats good news !!!dinghy wrote: ↑Fri Sep 23, 2022 3:01 pmOne jigsaw piece I don't understand is the election. If financial markets continue down sharply in the weeks ahead, the Dems are likely to lose both houses of Congress. Does Powell have full support from the Biden administration? He could potentially be thrown under the bus, considering he was appointed to the job by orange man bad. JPow could be accused of sabotaging the midterms for his insurrectionist buddy.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

Since 1980, we've been sliding down toward zero, so the hike cycles have been few and far between. But hikes haven't particularly been bad for stocks afaik.olds442jetaway wrote: ↑Sat Sep 24, 2022 12:23 amAs far as I know, there has never been a market turnaround to the upside if the Fed was still raising interest rates and that will continue.

Previous hike cycle ran from 2016 to 2019 with rates increasing from 0 to 2.5. Stocks were pretty much straight up. There was a 15% correction in late 2018, but you would have had to time it perfectly.

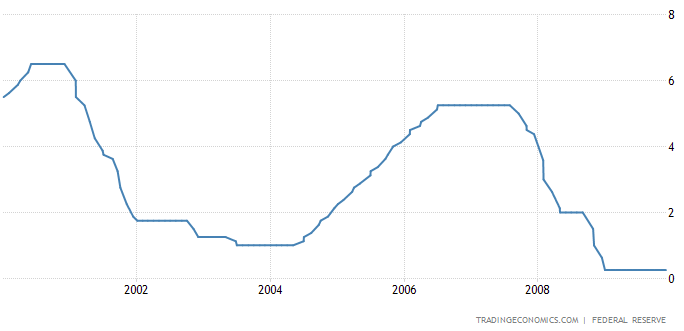

I want to show you the charts from the 2000s decade. Here's Fed Funds:

And S&P 500:

Those two charts are without a doubt positively correlated. So in the 2000s, you needed to embrace the hikes and avoid the cuts.

But central banks have grown increasingly powerful and activist. QE is when a CB pumps up financial asset prices. Japan started it in 2001, followed by the Fed in 2008. From 2008 to 2015, Fed Funds was pegged at zero, but QE inflated assets.

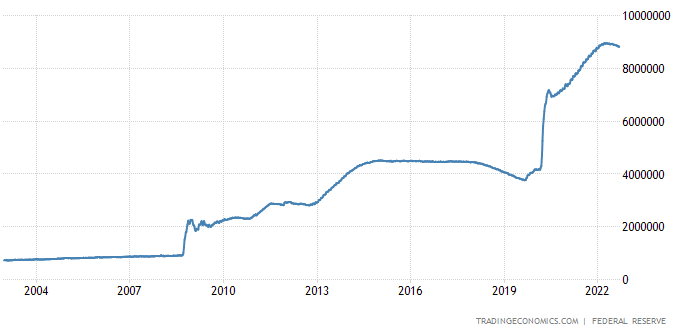

Here's the Fed balance sheet:

Currently $9 trillion, all-time high. Powell is talking tough on rates, but taking no action on balance sheet reduction.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

Correction. I think I created a problem that didn't exist.

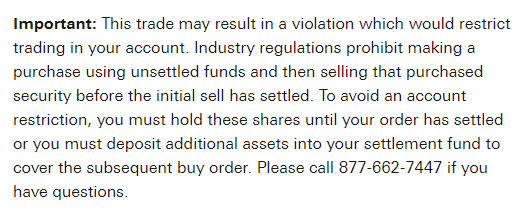

If you try to buy using unsettled cash, you get a scary warning. This is from Vanguard:

But really the only restriction is you have to hold the new shares through settlement. I can deal with that.

This means I'm flush with available cash going into Monday. Yay.

If you try to buy using unsettled cash, you get a scary warning. This is from Vanguard:

But really the only restriction is you have to hold the new shares through settlement. I can deal with that.

This means I'm flush with available cash going into Monday. Yay.