MARKETS,Anybody even yet?

-

FAA

- Video Poker Master

- Posts: 9470

- Joined: Wed May 28, 2014 11:58 am

Re: MARKETS,Anybody even yet?

Futures all down today. The rallies are strictly one day events. I made a bad investment decision that cannot easily be papered over. Two year clean up. I just don’t feel like doing anything anymore.

-

wildman49

- Video Poker Master

- Posts: 1362

- Joined: Fri Oct 05, 2012 10:45 am

-

olds442jetaway

- Video Poker Master

- Posts: 11415

- Joined: Tue Aug 21, 2007 9:08 pm

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

In the other thread you mentioned cars. There's only one significant ETF associated with the auto industry. Ticker symbol is CARZ, (formerly) Global Auto Index Fund.

Looking back at previous reports, typical holdings were as you would expect: Tesla, GM, Ford, Daimler, Honda, Toyota.

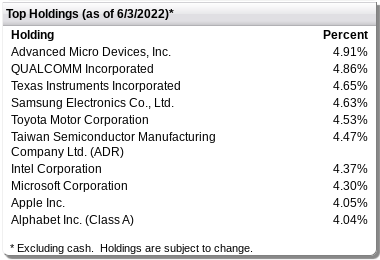

But then in January 2022, the fund rebranded as Future Vehicles and Technology ETF. Now it's chartered for 50% future vehicle companies and 50% technology companies. Current holdings:

It's now effectively a generic tech fund, the same as dozens of others.

There's one other "auto" ETF, with only $5 million of assets: VCAR, RoboCar Disruption and Tech ETF.

The theme is supposed to be autonomous driving, and it does hold Tesla, but look at some of the other top holdings: Nvidia, AMD, Apple, Intel, Amazon, Microsoft, Alphabet, Disney and Netflix.

Every ETF wants to own the same stuff. In my opinion, this is what you see at a top. It could also signal a bottom for auto makers (excluding Tesla) since no one cares about them.

-

olds442jetaway

- Video Poker Master

- Posts: 11415

- Joined: Tue Aug 21, 2007 9:08 pm

I do until I can break even on my 2 shares.

-

FAA

- Video Poker Master

- Posts: 9470

- Joined: Wed May 28, 2014 11:58 am

Retail apocalypse resumes. Target warning sends it tumbling. Plenty collateral damage. I sold only one here at a minor -5% loss last week for more cash weight and to avoid this very mess. Adios, Home Zero. Only Watch Party here is a horror show.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

Dip bought. TGT Tarzhay now back where it was before the warning.

Quarterly earnings release was only 3 weeks ago. The economy must be craptacular.

I'm reducing my remaining energy stocks. Corporate insiders are selling, and Cramer is buying. Still holding EC and YPF, and will buy much more if they go much lower.

-

FAA

- Video Poker Master

- Posts: 9470

- Joined: Wed May 28, 2014 11:58 am

Hell of a Target V shape. Everything 33% off, including the stock itself! Firm chose to dump six companies, including the HD headache. Still too many these days, of course. I managed to lose Monday and Tuesday gains today. All aboard for the long term clean up plan. I have tons of company.

-

olds442jetaway

- Video Poker Master

- Posts: 11415

- Joined: Tue Aug 21, 2007 9:08 pm

Yep you do. I wish I thought the sell off was over, but I don’t. I will gladly take a loss on my sqqq shares I am sitting on for a springboard upside. Alas! I have no confidence that will happen.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

I've got nothing short, and only enough cash for purchases in the event of a market dislocation.olds442jetaway wrote: ↑Wed Jun 08, 2022 10:39 pmI will gladly take a loss on my sqqq shares I am sitting on for a springboard upside.

The money from my energy stock sales went into VGSH, now priced below $59. Yield is near 2.8% for an approximate 2-year duration. The market fears an onslaught of Fed rate hikes, but I see a recession already in progress. Inflation may continue in some categories, but probably not very much overall.