MARKETS,Anybody even yet?

-

FAA

- Video Poker Master

- Posts: 9470

- Joined: Wed May 28, 2014 11:58 am

Re: MARKETS,Anybody even yet?

You’re missing all kinds of news! There’s so much to digest, at a very high rate of speed. I hope my experts let me catch a break today. I’m certainly due.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

Sorry, my bad.

My news attentiveness is almost as good as my reading comprehension.

-

FAA

- Video Poker Master

- Posts: 9470

- Joined: Wed May 28, 2014 11:58 am

I was an unfathomable +0.84 today. My report states that cash total is pending a change, so it did go through, and at respectable prices. It will be just 50% cash, but who can miss days like this? Investors are playing out this balancing act. I should have been half cash all along, of course.

-

olds442jetaway

- Video Poker Master

- Posts: 11415

- Joined: Tue Aug 21, 2007 9:08 pm

There is so much going on, next week is anybody’s guess. I believe we just had a Bear Market Bounce, but who knows. Big company earnings coming out, the debate of Value vs. Growth stocks, Unknown International tensions, savings being eaten away at every corner and stop, and a horrible surge in residential rents combined with a continued shortage of homes for sale in desirable areas. Add to that the whims of the Fed oscillating between a .75 or 1 percent rate hike next. The supply chain issues are still with us and on and on. Just like today, I have no predictions yet for Monday. There are too many candles burning at both ends and some will just not blow out.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

Long-term, cash has underperformed bonds.

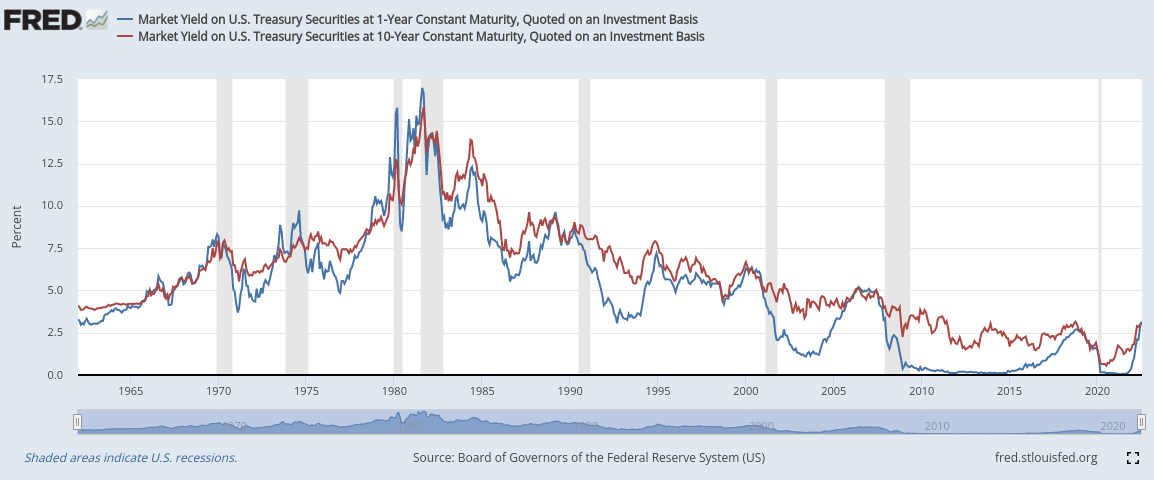

Blue line is the 1-year Treasury yield. Red is the 10-year. Usually the red line is above the blue.

I'm not sure there's any big SCHEDULED news. Quarterly GDP is not until the 28th afaik. FOMC announcement is Wednesday the 27th. Presently the market is leaning toward a 75 bip hike, but 100 is still in play.olds442jetaway wrote: ↑Fri Jul 15, 2022 8:21 pmThere is so much going on, next week is anybody’s guess.

I'm still adding gold miner shares on any further weakness. I'll chase them down as far as necessary. My dollar value is down, but I have more shares than ever before.

I'm contemplating big changes to my bond holdings due to the yield curve shift. Basically the highest yields now are within the 1 to 2 year durations. Longer durations are penalized with lower yields, and I hold plenty of longer durations including BIV, BND, TLT, VGIT, VGLT and VMBS.

But I'm not sure what to shift into. VGSH has a 2-year duration. Ideally I would like something with a 1-year duration, but the "ultra short" duration ETFs are heavy on corporates rather than Treasuries.

-

olds442jetaway

- Video Poker Master

- Posts: 11415

- Joined: Tue Aug 21, 2007 9:08 pm

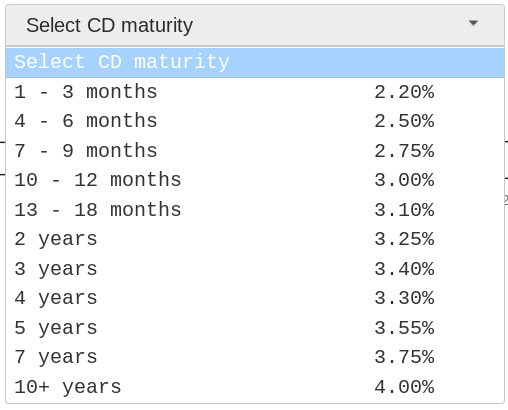

Why not 8-9 month CDS at just under 3 percent and no risk of loss on the investment? Maybe not the best move, but that’s what I did.

-

FAA

- Video Poker Master

- Posts: 9470

- Joined: Wed May 28, 2014 11:58 am

I will definitely make an appointment to discuss parking it for nine months at that rate. Who needs more worries these days? Economy will be sideways in that window, best case.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

olds442jetaway wrote: ↑Sun Jul 17, 2022 12:23 amWhy not 8-9 month CDS at just under 3 percent and no risk of loss on the investment?

I prefer VGSH at 3.1% because I think a price gain is more likely than a loss.

If markets are correct, the Fed will hike to 3.5% while you're locked in at 2.75%.

The longer duration CD yields are intriguing because they're far above Treasury rates. But you are locked in, and some of them may be callable. I didn't look at the details.

One could also consider VCSH which is corporate instead of government. Yield 4.1%, and duration is about 3 years instead of 2. If you went 50/50 VGSH/VCSH, you'd have a 3.6% average yield.

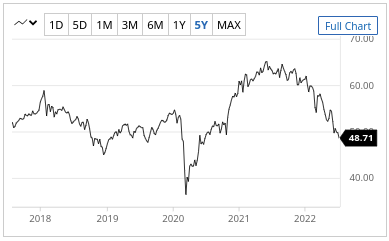

Not saying you're wrong, but you're more confidently bearish than I am. You only have to look back 2 years to see what's possible:

That's SPY. Stocks recovered all their losses by August 2020, amid widespread lockdowns during a raging pandemic with no vaccine available, and an incumbent president worse than Hitler.

Stock rallies in a bear market don't need good news. They merely need less severe bad news.

Also if you're bearish USA, you have other options. You can diversify internationally. Here's VEU which includes everything worldwide except USA:

If I could only buy one or the other, I'm going with VEU, and it's not a close decision.

-

olds442jetaway

- Video Poker Master

- Posts: 11415

- Joined: Tue Aug 21, 2007 9:08 pm

Fidelity only charges a fee of a dollar to sell the CD if you change your mind on the secondary market. Banks loss of interest and principal is ridiculous for breaking a CD early.

-

wildman49

- Video Poker Master

- Posts: 1362

- Joined: Fri Oct 05, 2012 10:45 am

That was a bubble rally from 7t the FED dumped in the economy, not going to see that again any time soon we should however put in a bottom in Sept/Oct much lower from here. Only chance of sell off being over is if Fed stops rising rates, don't see that till 2023.