MARKETS,Anybody even yet?

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

Re: MARKETS,Anybody even yet?

I found the anti-Coty!

New position in FLO Flowers Foods.

From a 2014 "New York Times" article:

"The most Republican-leaning company in the country, based on political donations, isn't Koch Industries. It's the company that makes Wonder Bread.

"The political action committee of Flowers Foods, a Georgia company that produces the pillowy sandwich bread, Tastykakes and Nature's Own baked goods, has given more than 99 percent of its political contributions since 1979 to Republicans."

New position in FLO Flowers Foods.

From a 2014 "New York Times" article:

"The most Republican-leaning company in the country, based on political donations, isn't Koch Industries. It's the company that makes Wonder Bread.

"The political action committee of Flowers Foods, a Georgia company that produces the pillowy sandwich bread, Tastykakes and Nature's Own baked goods, has given more than 99 percent of its political contributions since 1979 to Republicans."

-

olds442jetaway

- Video Poker Master

- Posts: 11445

- Joined: Tue Aug 21, 2007 9:08 pm

I have a Cracker Barrel 2 miles from home. They are officially boycotted now. being an antique buff and history buff as well, As far as I’m concerned, they’ve ruined everything with the remake. Please ignore the capitalization and punctuation, etc. very difficult to get the cursor where I want it and Siri is an idiot.

-

olds442jetaway

- Video Poker Master

- Posts: 11445

- Joined: Tue Aug 21, 2007 9:08 pm

Royal Gold came roaring back Of course after I sold it. Luckily I still have WDOFF.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

You basically just needed to own any of them. This has been an assertive move by gold equities vs gold.olds442jetaway wrote: ↑Thu Aug 21, 2025 2:46 pmRoyal Gold came roaring back Of course after I sold it. Luckily I still have WDOFF.

Month to date, GLD is slightly negative while my industry holdings are +10 to 30%. The only notable laggard has been WDOFF at +2%.

I'm considering a partial rotation from miners to bullion. PHYS is the Sprott version of GLD. It trades at a 1.6% discount. CEF is Sprott's blend of ~70% gold and 30% silver. It's discounted at 3.5%.

Another option is Sprott itself, trading as ticker SII. The stock is having a rough month for no apparent reason. Earnings looked good.

-

olds442jetaway

- Video Poker Master

- Posts: 11445

- Joined: Tue Aug 21, 2007 9:08 pm

I’m surprised WDOFF hasn’t taken off yet. Maybe the difficulty is getting to its gold, but it has no debt as far as I know among other good news with its finances. More and more analysts not just the fly by nights are predicting 5,000 dollar gold. I haven’t researched how much the AI industry needs it. I don’t pay much attention to analysts, but other people do and that in itself could keep propelling gold up. Less investing in the US Dollar by other countries and investors could contribute too.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

My best explanation is that nobody knows about it. On social media or message boards, gold miners barely register a pulse of activity.

That's a tough one because it's really hard to assign an objective valuation to gold. I like it for diversification/protection. I think gold attracts enthusiasm as investors lose confidence in government authorities as stewards of fiat currencies. The current crop of world leaders is pathetic. They hate their own citizens and want to replace them.More and more analysts not just the fly by nights are predicting 5,000 dollar gold.

-

FAA

- Video Poker Master

- Posts: 9479

- Joined: Wed May 28, 2014 11:58 am

Great market day yesterday, with rumblings of an imminent cut. Shorts got some beating. I look at them as the No Pass craps players. Much higher stakes, ofc.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

Is this good?

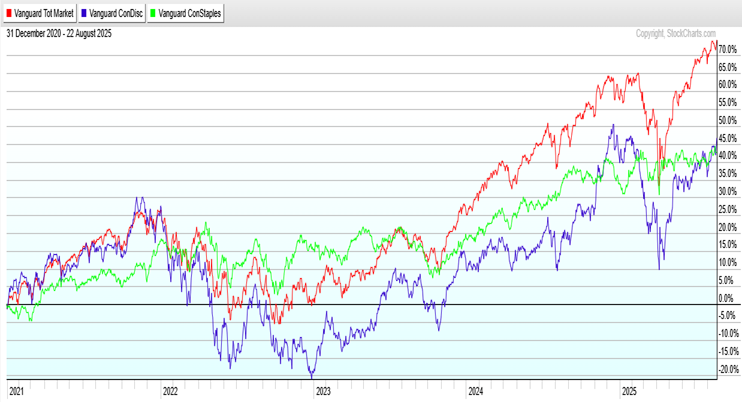

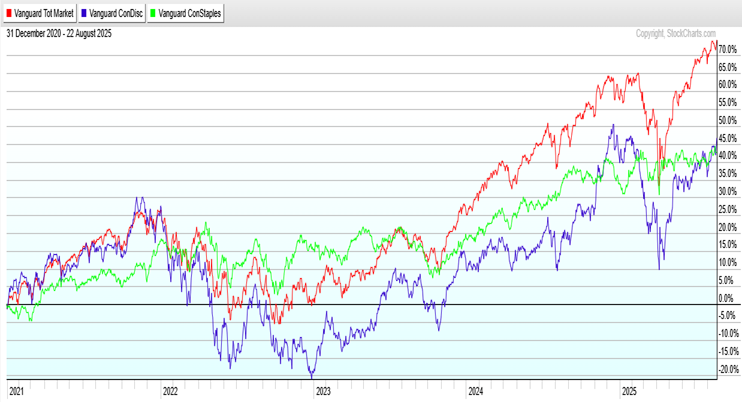

Red line is VTI total US stock market.

Blue is consumer discretionary (VCR). Green is consumer staples (VDC).

A prosperous economy should enable consumers to buy the things they want and need. But it looks like they aren't buying.

The red line appears disconnected from reality.

Red line is VTI total US stock market.

Blue is consumer discretionary (VCR). Green is consumer staples (VDC).

A prosperous economy should enable consumers to buy the things they want and need. But it looks like they aren't buying.

The red line appears disconnected from reality.

-

FAA

- Video Poker Master

- Posts: 9479

- Joined: Wed May 28, 2014 11:58 am

Yes, there is a strong sentiment that the market is oversold and fueled by hope and dreams. I wouldn't be comfortable with that graph either.