MARKETS,Anybody even yet?

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined Forum: April 29, 2019

- View Player Page

Re: MARKETS,Anybody even yet?

Losers:

NFE New Fortress -93%

KOS Kosmos -58

LULU Lululemon -55

HUN Huntsman -48

VTLE Vital -43

DOW -39

UNH United -35

BAX Baxter -35

LYB Lyondell -34

ATUS Optimum -26

NFE New Fortress -93%

KOS Kosmos -58

LULU Lululemon -55

HUN Huntsman -48

VTLE Vital -43

DOW -39

UNH United -35

BAX Baxter -35

LYB Lyondell -34

ATUS Optimum -26

-

FAA

- Video Poker Master

- Posts: 9541

- Joined Forum: May 28, 2014

- View Player Page

Two decent trades last week. I bought six JNJ at $186. I bought two more Microsoft at a mere $499.

-

olds442jetaway

- Video Poker Master

- Posts: 11567

- Joined Forum: August 21, 2007

- View Player Page

MSFT already up 10 or so. Time will tell if their huge AI project will pan out. JNJ way up for the year. More to go? At least a decent Div. 2.6 or so.

-

olds442jetaway

- Video Poker Master

- Posts: 11567

- Joined Forum: August 21, 2007

- View Player Page

Hmmmmm, Trump bought over the last few months over 82 million in bonds. That tells me pressure on the Fed to continue to lower interest rates will continue. Bad for CDs and Money Market. Good for Bonds. One reason I have been loading up on high dividend stocks and funds for over a year. That said, the world is so nuts with things going on I guess anything could happen. I’ve also been adding to miners to use in trades and food related stocks hoping for a comeback and dividends of 4 percent or more while I wait. Almost no Mag 7 held individually.

-

wildman49

- Video Poker Master

- Posts: 1363

- Joined Forum: October 5, 2012

- View Player Page

Trump wants Fed rate of 1% this could happen next year once he puts in new Fed head to replace Powell. Bonds will be the place to be.olds442jetaway wrote: ↑Sun Nov 16, 2025 10:00 pmHmmmmm, Trump bought over the last few months over 82 million in bonds. That tells me pressure on the Fed to continue to lower interest rates will continue.

This market has all the feel of 2000-2001 right now all rally's being sold, Bitcoin in crash zone.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined Forum: April 29, 2019

- View Player Page

We're all agreed that Trump wants near-zero rates (because he's a simpleton), and probably has sufficient power to get them.

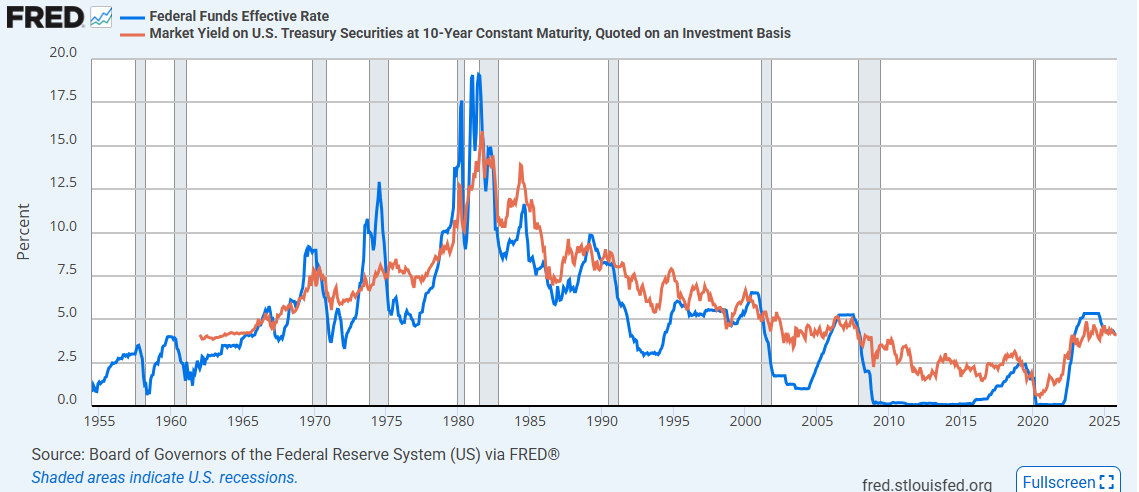

In general, the "long end" (orange line) has behaved calmly.

The risk however is that the Fed "loses the long end" -- i.e., Fed cuts blue line to 1%, but long durations spike to 6 or 7.

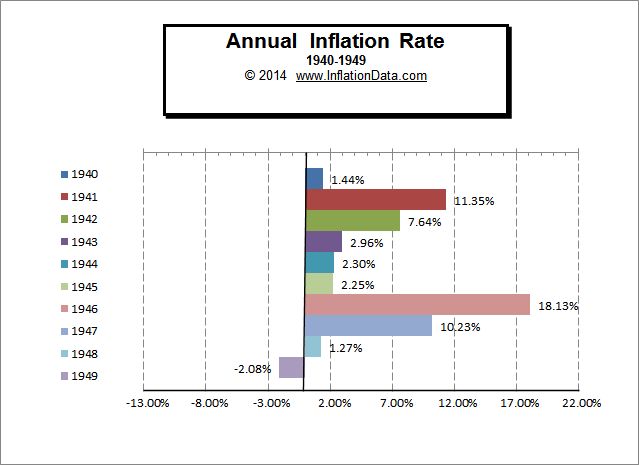

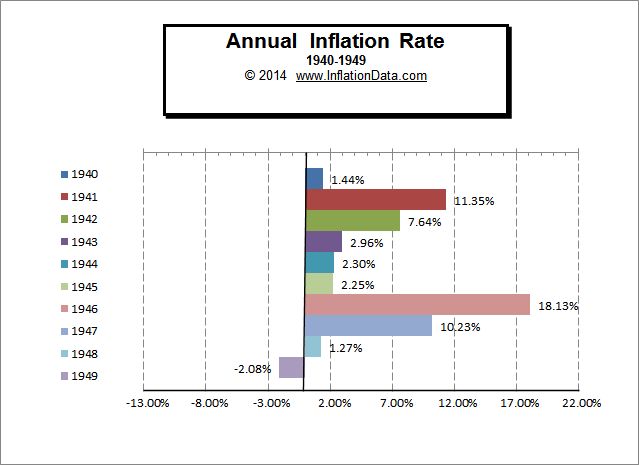

Afaik, the only prior analogy is the 1940s. To restrain yields at all durations, the gov conducted yield curve control. Rates were artificially capped in the 2% area, while price inflation raged.

Add 80 to the years shown, and you have a possible current-decade scenario. 1941-2 is similar to the 2021-2 Covid reaction. Then we would get another jolt of price inflation into the middle of Trump's term.

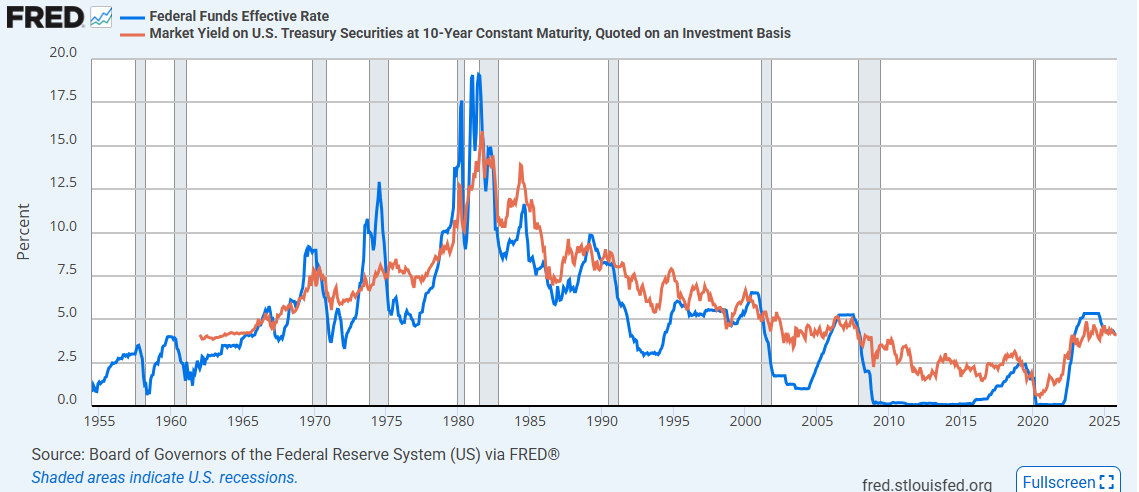

I think YCC will be attempted, which is why I like TLT. But YCC has been done many times in many countries, and usually fails.

In general, the "long end" (orange line) has behaved calmly.

The risk however is that the Fed "loses the long end" -- i.e., Fed cuts blue line to 1%, but long durations spike to 6 or 7.

Afaik, the only prior analogy is the 1940s. To restrain yields at all durations, the gov conducted yield curve control. Rates were artificially capped in the 2% area, while price inflation raged.

Add 80 to the years shown, and you have a possible current-decade scenario. 1941-2 is similar to the 2021-2 Covid reaction. Then we would get another jolt of price inflation into the middle of Trump's term.

I think YCC will be attempted, which is why I like TLT. But YCC has been done many times in many countries, and usually fails.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined Forum: April 29, 2019

- View Player Page

Some good news from Chile. The idiot communist got the most votes at 27%, but her major opponents were all right-wing. Jose Kast opposes her in the runoff, and is the presumed winner at 95% probability on Polymarket.

ECH Chile ETF is +4%, and I'm up big on my SQM which is +12% today. Now taking some profits on both, but it's nice to see South America moving away from mental illness (while the US embraces it).

ECH Chile ETF is +4%, and I'm up big on my SQM which is +12% today. Now taking some profits on both, but it's nice to see South America moving away from mental illness (while the US embraces it).

-

olds442jetaway

- Video Poker Master

- Posts: 11567

- Joined Forum: August 21, 2007

- View Player Page

Yep. Another one elected in Seattle.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined Forum: April 29, 2019

- View Player Page

Before people lost their minds, plain women were encouraged to become nuns -- where they couldn't do any harm.

-

wildman49

- Video Poker Master

- Posts: 1363

- Joined Forum: October 5, 2012

- View Player Page

Shorts having a field day in the crypto complex.