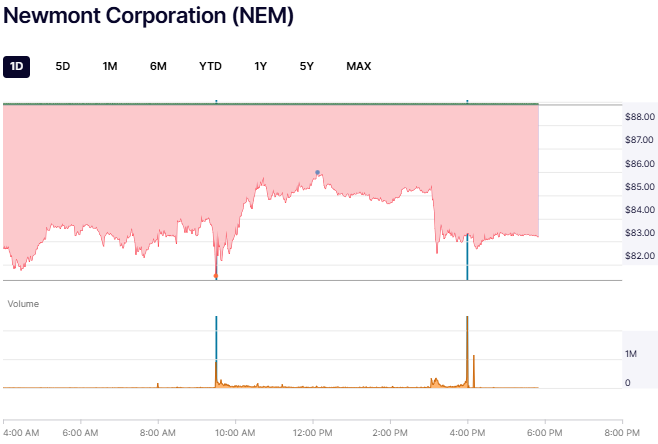

NEM was rolling along near 83, but then collapsed 2% in an instant.

Spectacular buying opportunity imo, except for the widened bid-ask spread compared to normal. I got one fill (at 81.33) and one fail (81.28).

Then late in the session, NEM crashed 3% on a rumor that it will buy full ownership of the Nevada Gold Mines venture from Barrick. Newmont is cash-heavy from its asset sales and gushing cash flow. One reason people hate gold miners is because they've historically done bad deals at cycle tops.